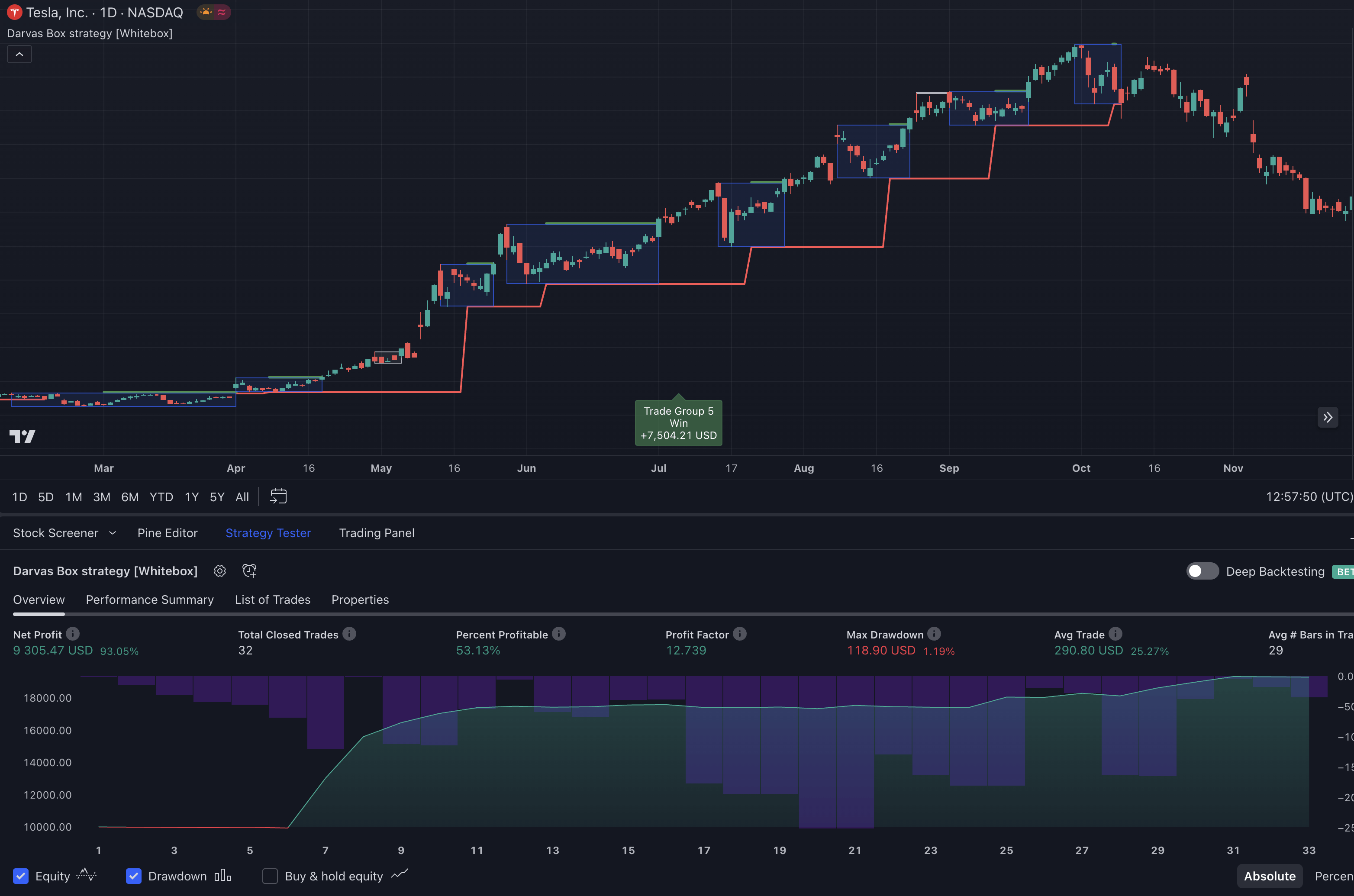

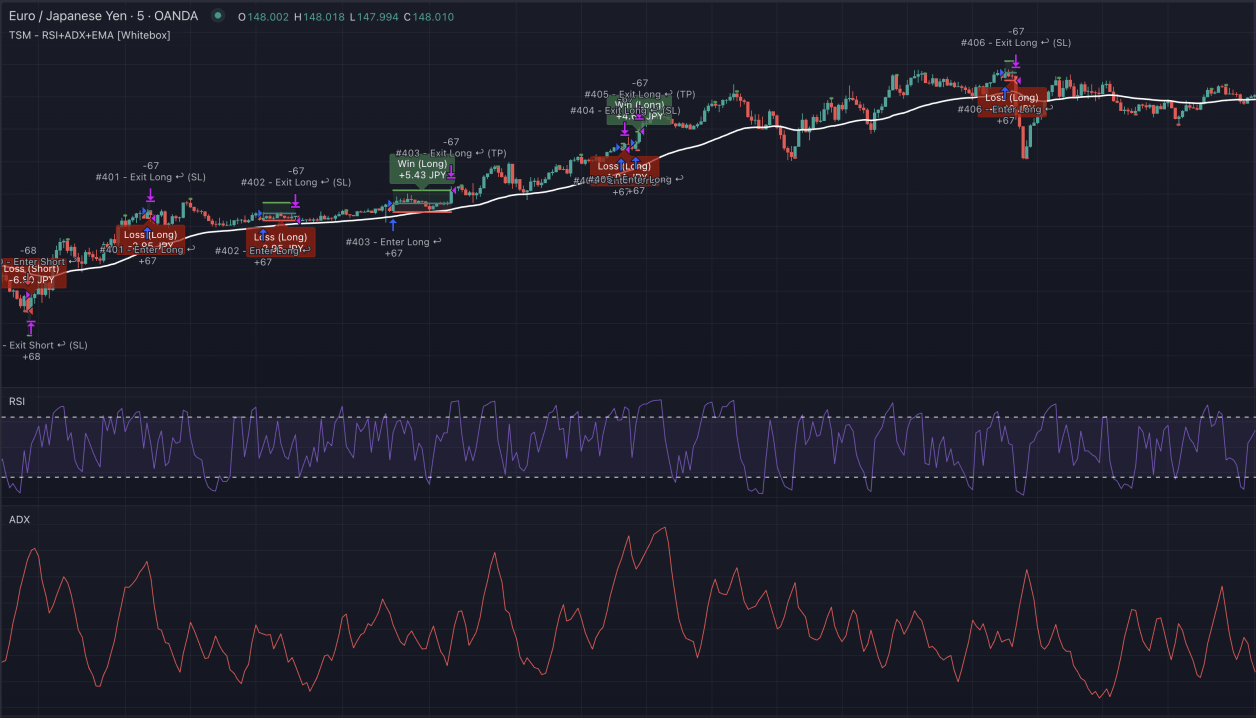

We build indicators that use well-known technical analysis algorithms for producing buy and sell signals. When you use our indicators, you will fully understand why it produced a buy or a sell signal.

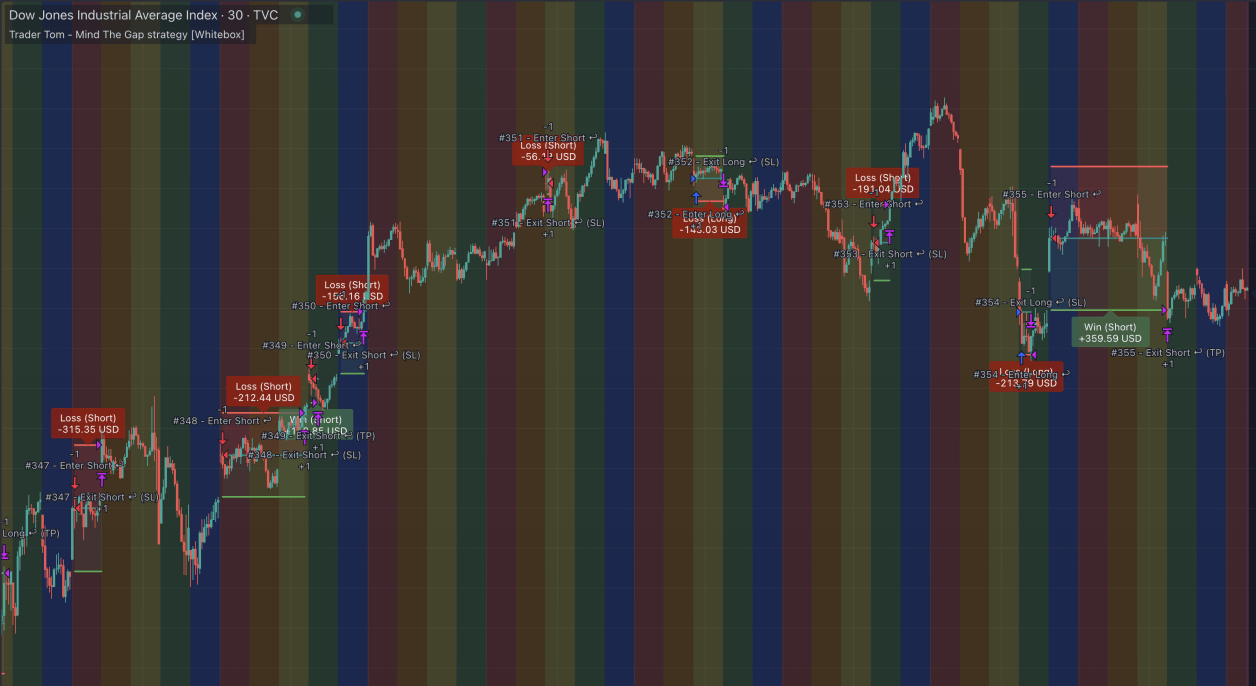

Most companies that sell trading indicators online tend to provide traders with tools that function as a

black box

. A

black box is a system that produces information without revealing anything about its inner workings. Once you add such an indicator to your chart, all you have to do is sit back and wait for the buy/sell signals to pop up. Once they show up, you have no idea why a particular signal appeared. This is because you don't know what algorithm the indicator uses to produce those signals; the company considers the algorithm proprietary. Because of this, people tend to think that the makers of such indicators possess knowledge that others don't. This is rarely the case, however. Instead, what usually happens is that they repackage well-known, decades-old technical analysis indicators (e.g. they rename Bollinger Bands' upper and lower bands to "Northern Cloud" and "Southern Cloud") and sell them as their own creation. Unsuspecting beginner traders buy into this apparent magic, and they assume they have found the Holy Grail of trading.

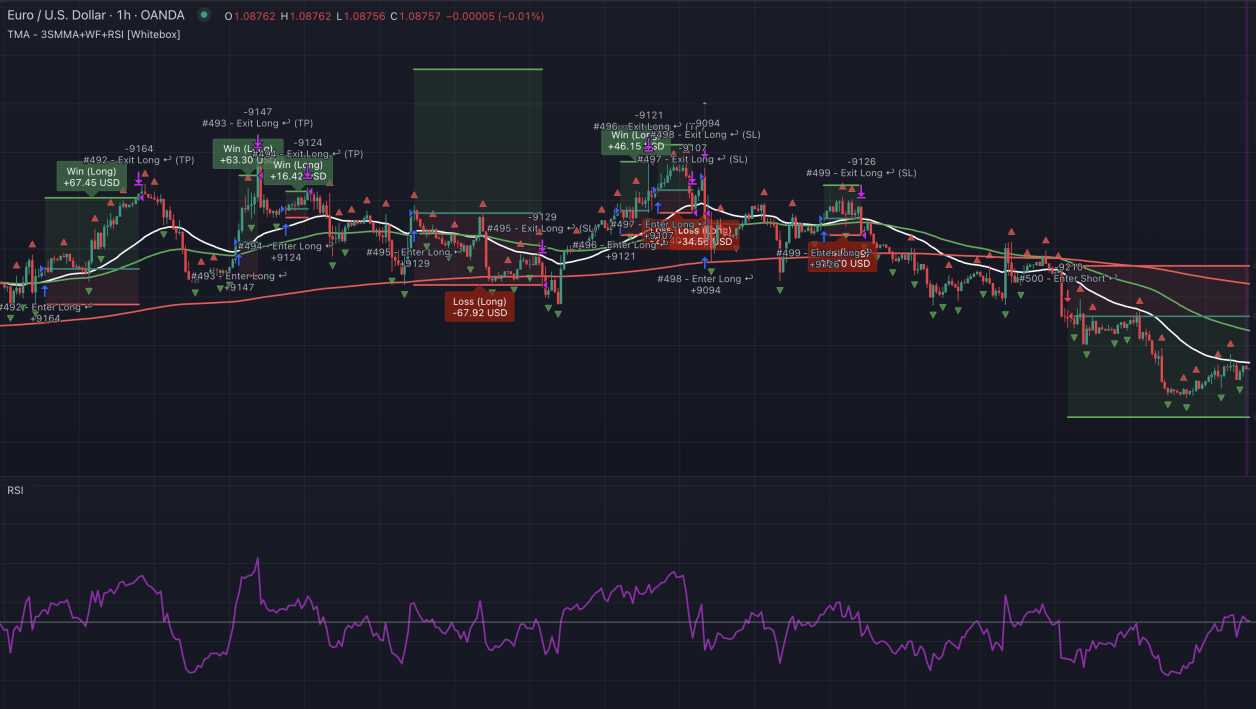

On the other hand, there are systems that are fully open & transparent, with their inner working entirely exposed to the user.

These are called

white-box systems.

We at

Whitebox Software believe in transparency. We believe that magic has no place on the charts. Technical analysis has no magic to it, after all. On a standard candlestick chart, there are five pieces of information available to everyone: the

open, high, low, and

close prices of each candle and the

volume that was traded during those candles. Every technical analysis indicator sold on TradingView uses some or all of these values to suggest whether it considers a particular asset to be bullish or bearish.

The indicators and strategies we built all use a combination of well-known, documented, decades-old algorithms to produce their signals. We call each indicator by its name, so you don't have to wonder why the script decided to open a position.